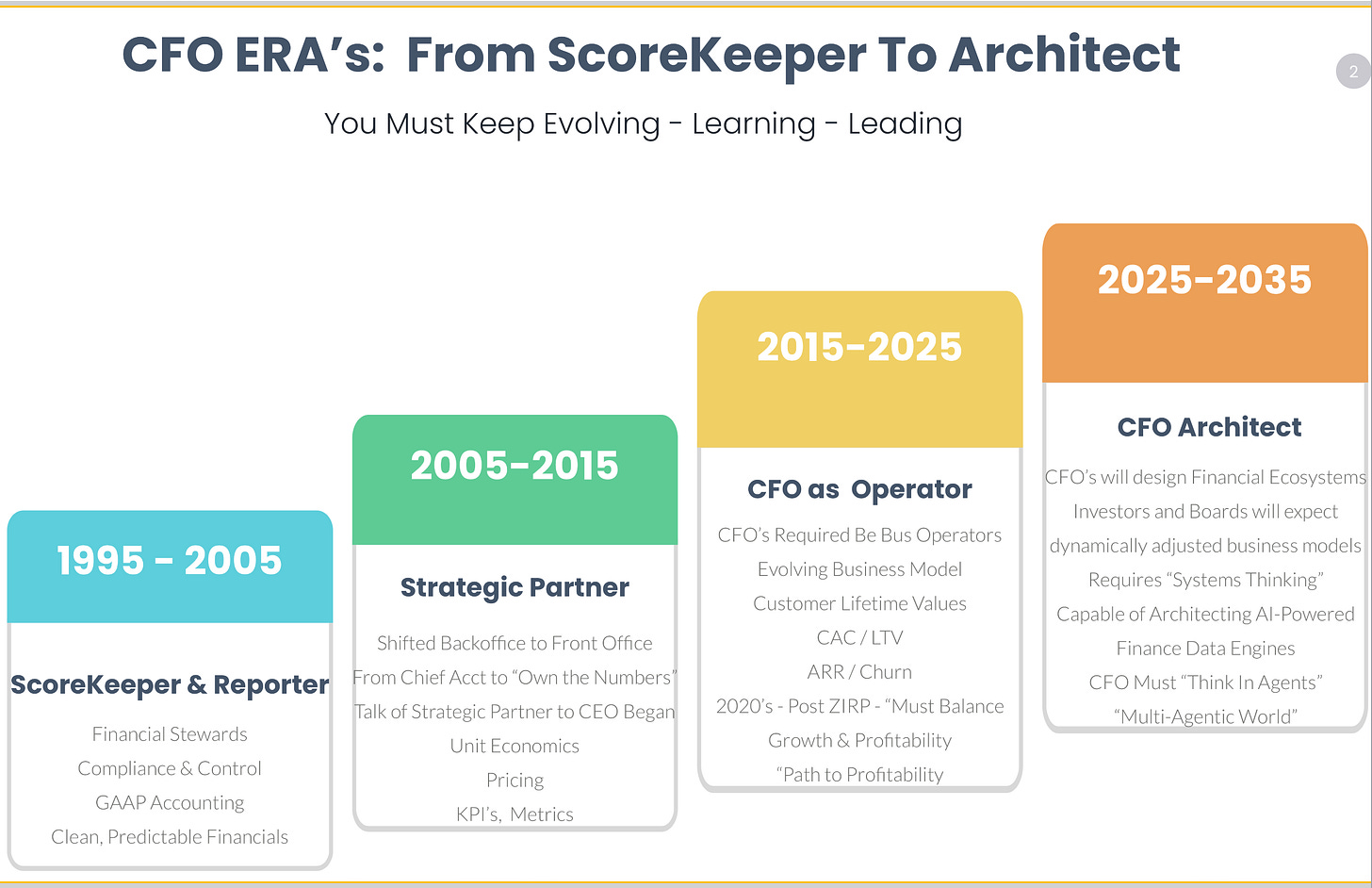

Welcome back to the CFO Roadmap Series. In Part 1, I set the context for “where CFOs have been”, “where they are today”, and “where they need to go” by introducing the concept of Eras of the CFO’s journey.

Part 1: Summary Slide

Below is a slide based on Part 1 that I’ll be using for next week’s CFO Summit Day, where I’m speaking and leading a panel. For any readers who are also attending next week’s event, you’ll be slightly ahead of the audience and able to fire questions at me and the panel more quickly.

Part 2:

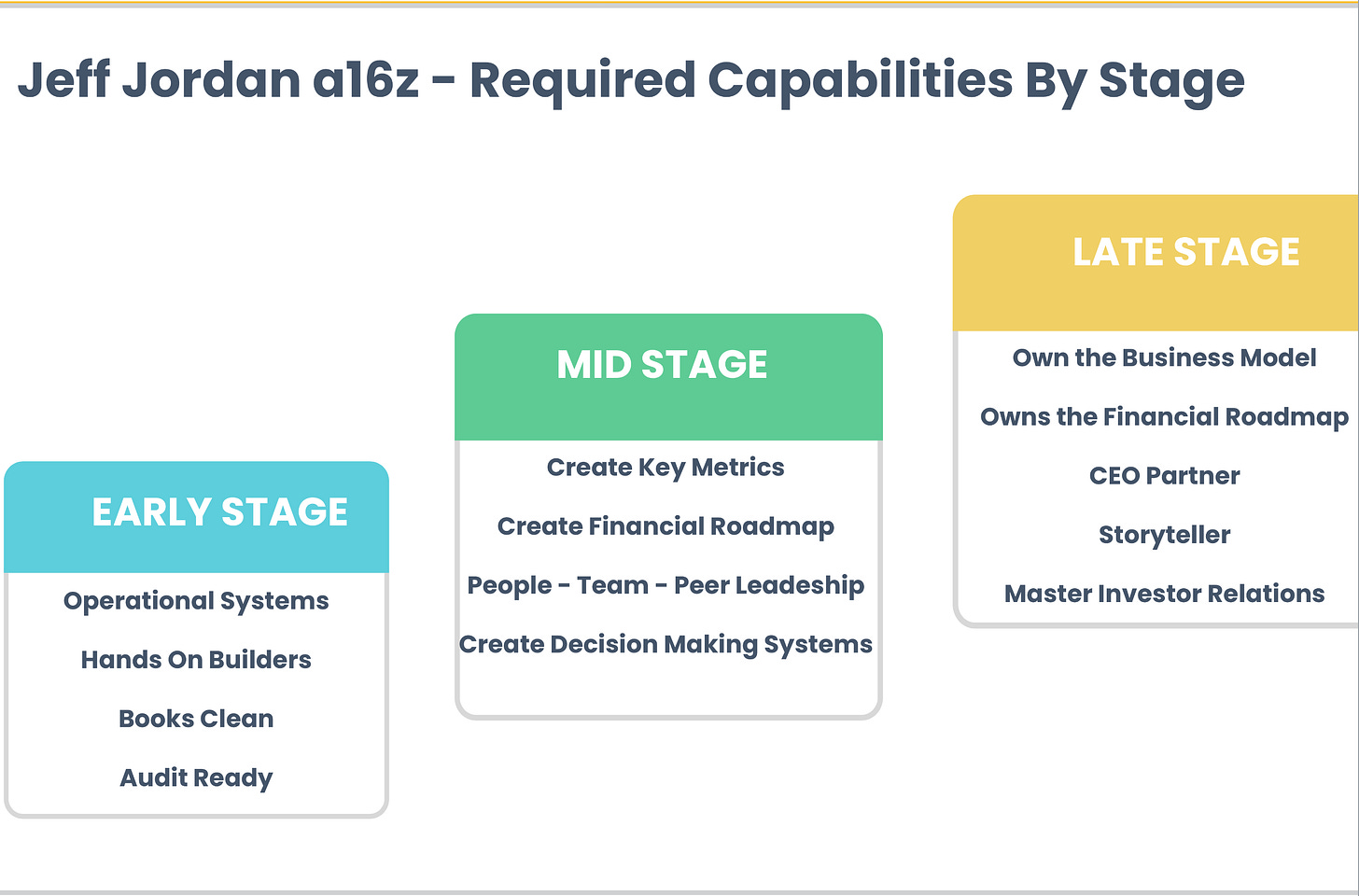

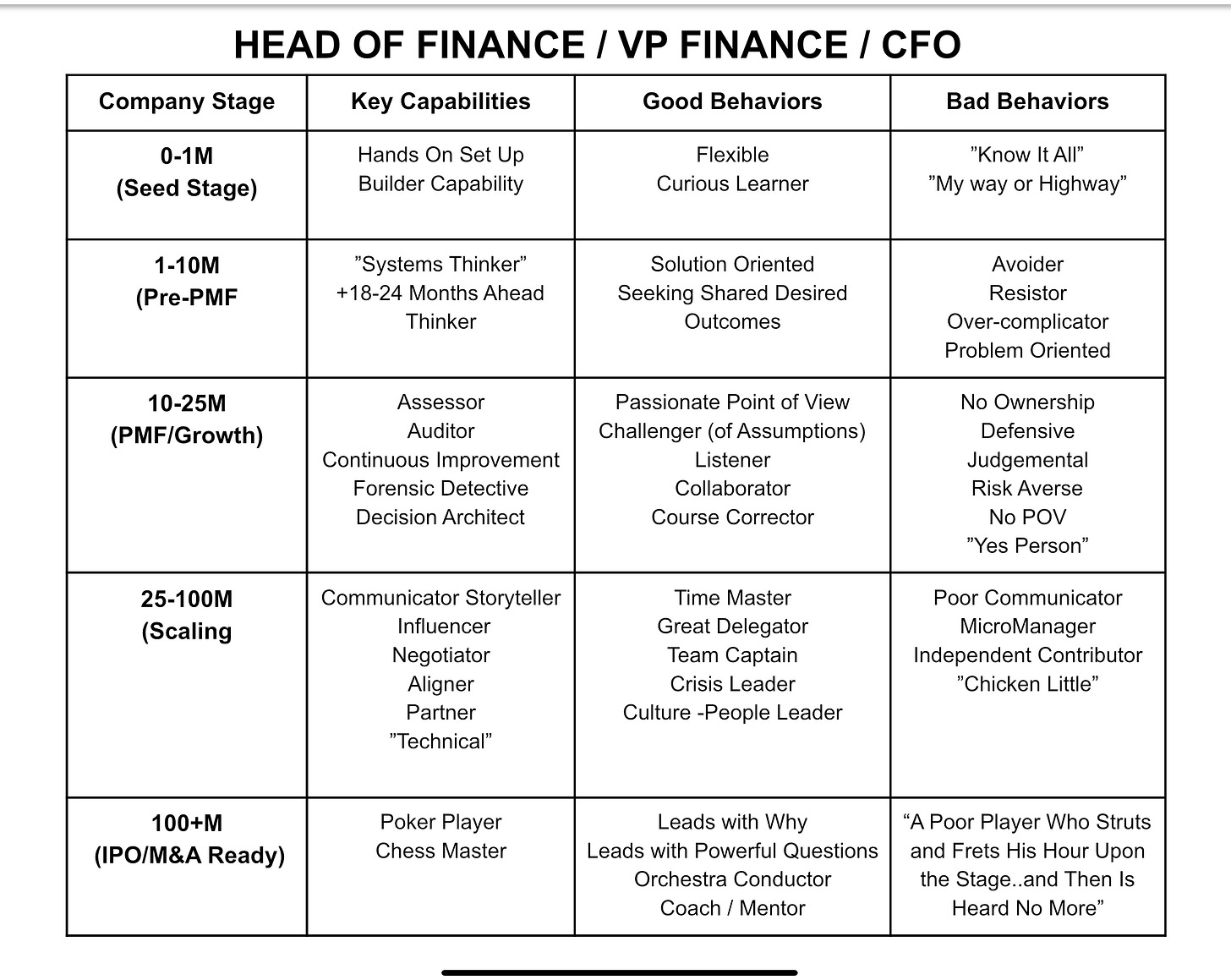

In Part 2, we can now dig deeper into specific finance maturity capabilities required along the CFO journey. Since I always promise “Best Ofs”, the below slide is a mashup of Jeff Jordan’s (a16z) writings on this similar subject and my own perspectives.

I broke down Jeff’s thinking by stage of company and applied my own themes for what the head of finance needs to build along their journey to eventually becoming CFO of a later-stage company.

I’ve created another CFO Journey slide mashing up these core concepts of not only the historical CFO Eras but also to emphasize how the CFO’s role needs to evolve and mature as the company matures.

KEY POINT: It’s “Day One” for CFOs

As Jeff Bezos constantly says, “It’s Always Day One” for Amazon. This holds true for CFOs and, quite frankly, any leader. A “great” head of finance at Series A is not the same as a great CFO at Series C and is likely wholly different than a Great CFO for IPO. Each stage of venture-backed financial leadership requires different functional and leadership capabilities and leadership behaviors.

Misalignment of these capabilities and behaviors vs. your company stage and having an underperforming CFO leader vs. “What We Need Now” can be very damaging to a company. This misalignment risk is compounded by the fact that finance as a function remains too opaque, operating behind a proverbial black curtain leaving gaps and opinions of what great looks like by finance’s customers - CEOs, Boards/Investors, and Executive Peers.

This Part 2 hopes to lay down a better standard of what great finance by stage looks like so we can begin to eliminate the gaps and opinions and be much more clear and transparent about “Great by Stage.”

What can we all likely agree on?

Whatever level of finance maturity you are currently at will require constant learning and evolving toward the next level of “Great CFO.”

Your impact and success as a CFO requires adding new capabilities and leadership behaviors along your CFO journey.

And specifically avoiding the bad behaviors.

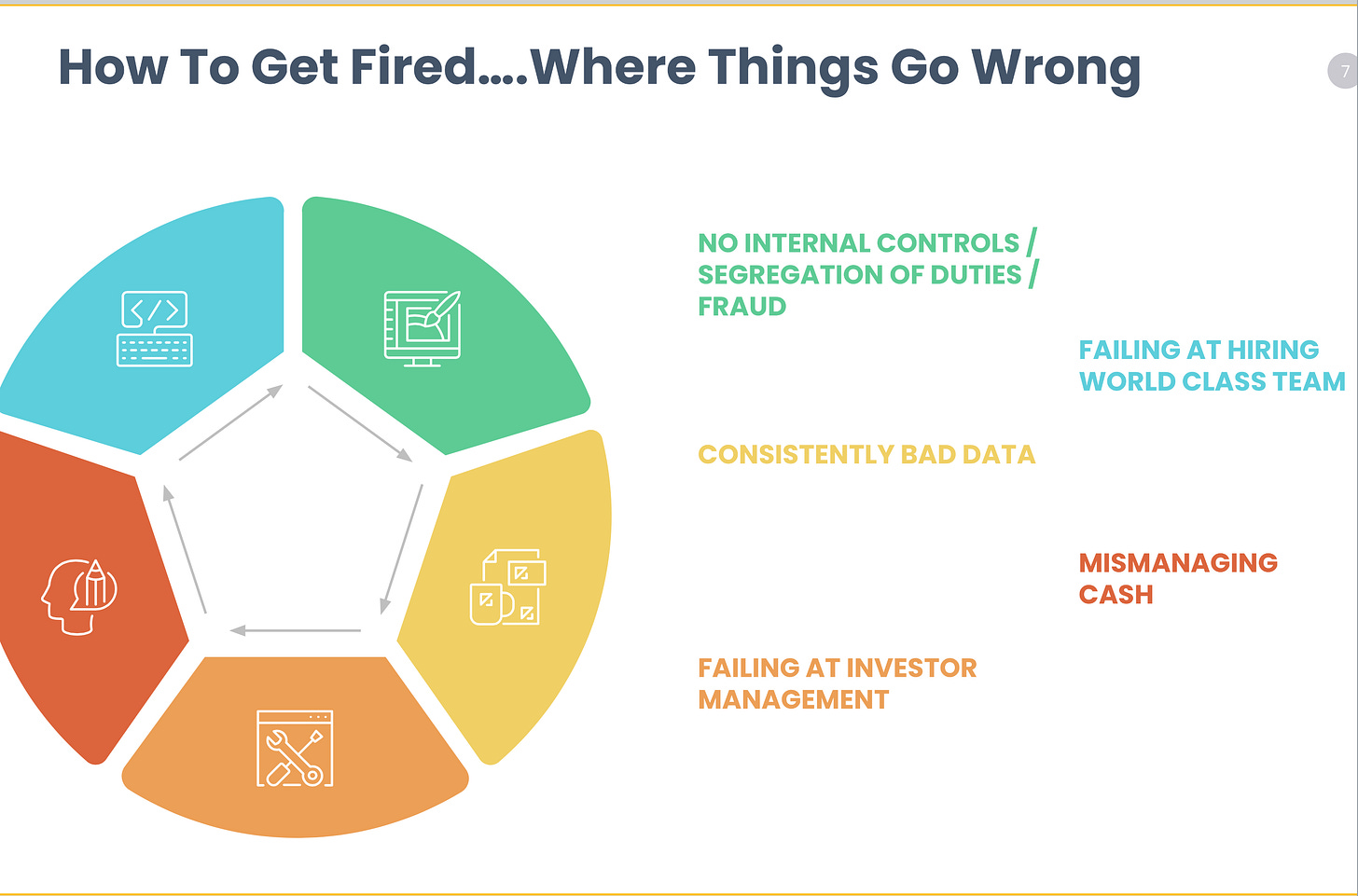

Hot Take: You will be fired as CFO 80% of the time based on bad behaviors vs. your lack of functional capabilities required for your stage. Alternatively, you will be “leveled” (VP of Finance, not promoted to CFO) if you exhibit good leadership behaviors but don’t have the technical leadership capabilities for your stage.

Here’s another slide to bring the point home from the same presentation deck that Ivan Makarov (a16z) and I are working on for the CFO Summit Day 2025

Bottom Line: You must evolve both your capabilities and your behaviors to succeed.

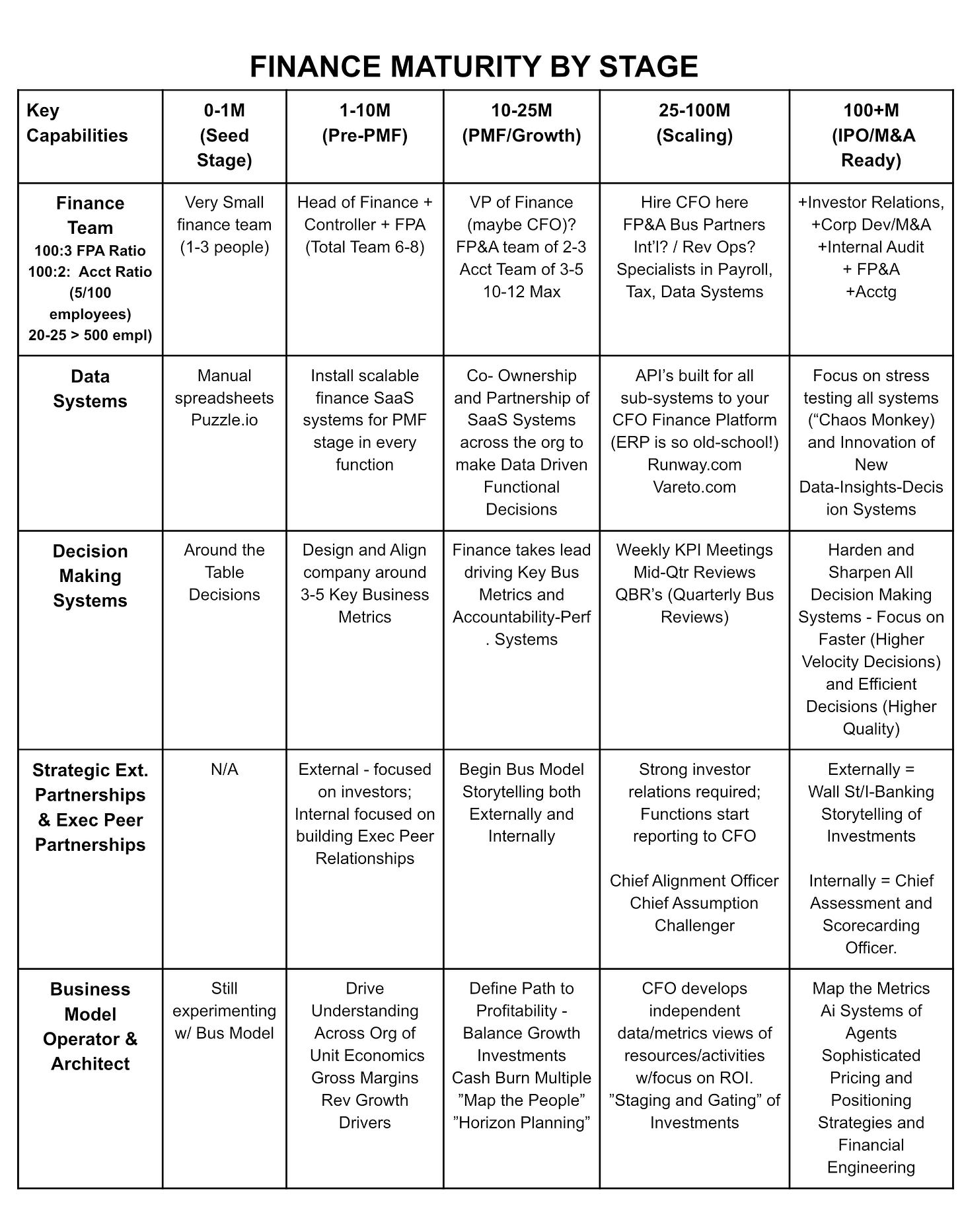

Here’s a summary table of Finance Maturity capabilities and behaviors by company stage I’ve been working on and is now ready to post.

And here’s a table summarizing the capabilities by theme and adding Good and Bad Behaviors.

Here’s a quick bullet point summary…

Series A (Seed and Pre-Prod Mkt Fit - 0-10M Revenue):

Head of Finance is a “Builder”

Successful:

Builds foundational financial systems, processes, and controls.

Creates timely, accurate, and consistent financial reports and creates “confidence” that “finance” is under control and solid.

Next-level blocking/tackling gets put in place, legal compliance, audit and tax compliance, and equity/cap table is clean.

Establishing board and investor financial reporting rhythm and rigor.

What Doesn’t Work:

Overcomplicating processes and over-controlling too early (e.g., hiring a large finance team when a 2-3 person team suffices).

Applying late-stage CFO playbooks.

Thinking about EBITDA too soon instead of balancing innovation to revenue growth to headcount to cash runway. These are your core metrics.

Series B (10-25M Revenue; PMF; )

Finance Team Needs to Partner and Enable Growth

What Works:

Leading with an over-arching financial philosophy.

You are Chief Focus Officer (CFO) even if you don’t have the CFO title yet. Your role is to make sure your team avoids chasing the next bright, shiny idea.

Make sure the company has a clearly defined strategy. If you don’t, then stop the presses and make sure your company starts with a clear strategy. Strategy must come first before you structure the organization and, certainly, before you randomly execute in hopes of finding a strategy.

Begin learning and practicing data-driven storytelling of the financials every chance you get. In your regular executive team meetings, at board meetings, with your direct finance team, with other functional teams, and in front of all company meetings and offsites. Every communication is an opportunity to hone your storytelling skills.

You must be thinking and planning 18 months ahead in this stage.

Partner with your “finance customers”, your executive peers, your board/investors, and especially your CEO.

Make sure the business has 3-5 key metrics and communicate and coach the hell out of them, including unit economics, margins, and ROIs as part of your storytelling practice.

At this stage, your FP&A team needs to really begin ramping up by building out internal dashboards, business reviews (QBR’s - quarterly business reviews), and hardening decision-making systems. Bring in FP&A systems like Runway or Vareto as foundational planning tools across the organization.

What Doesn’t Work:

Saying “yes” to all executive peer headcount and resource asks vs. saying “not yet” or “not right now.”

Forgetting you are a Chief Focus Officer (CFO).

Not “Owning the Numbers”.

Scaling fixed costs too early (hiring and significantly spending ahead of revenue).

Not staging and gating people and investments, and not leading by investing more in what's working and less in what's not.

Underestimating the importance of financial storytelling to investors.

Staying addicted to Excel as your primary reporting and planning tool.

Series C: (25-100M); Scaling Growth; Rule of 40

CFO as the Scalability Leader

What Works:

Moving beyond cash burn focus and driving financial ownership down into the organization to create financial discipline of your executive peers and CEO.

Stress testing financial controls, preparing for audits.

Exploring new revenue streams and international expansion planning.

Being capable of small M&A or acqui-hire investments.

Partnering with Go-To-Market teams to align finance with sales efficiency (e.g., CAC payback, net retention).

Begin experimenting with new Ai Agents to solve manual tasks. I’ll go deeper on this in an upcoming post after this series as I’m currently attending the HumanX Ai conference and can surface some examples post-conference.

What Doesn’t Work:

Focusing only on cost-cutting or focusing only on revenue growth instead of path to profitability. If you don’t lead with smart ROI investment principles at this stage, you are setting yourself up for some painful reorganizations and future RIF’s.

Not properly supporting innovation in the business. Avoid "Goldilocks innovation": no multiple moonshot projects at once, but also avoid cutting all non-revenue-generating experiments. Find the proper balance of what I call "Constraint-Driven Innovation."

Inability to make high quality + high-velocity decisions and inability to build Course Corrections into your decisions.

Late Stage: CFO as Public Market/M&A Readiness Officer

What Works:

Building the foundational elements inside your finance team and other admin functions to become IPO ready and/or M&A ready (S-1 prep, SOX compliance, public company controls, virtual data rooms).

Spending more time external networking, partnering with auditors and bankers, and attending and speaking at key industry events.

Balancing growth & profitability between agile financial planning and ensuring a strong balance sheet.

Managing investor relations at a public company level sophistication.

Creating long-term financial strategies and operating models (2-3 years).

In these later stages, you must become a master financial orchestra conductor and a better delegator with your finance team operating more and more autonomously.

Right-hand partner to the CEO and increasingly becoming the internal financial and operating CEO to the company.

What Doesn’t Work:

You cannot think, act, or lead like a startup CFO anymore.

Underinvesting in audit, compliance, and investor relations.

Not understanding what your “Finance Product” is at this stage and who your “Finance Customers” are. Hint: Your top finance customers are no longer your internal executive peers and operating teams. Your customers are increasingly external at this stage.

But Jim, I don’t have time to do all this!

I hear you. My response is you must make the time to learn and evolve or you’ll have plenty of time on your hands. Here’s a final slide to bring this point home:

Conclusion: Financial Maturity - the CFO Journey by Stage

The best CFOs are constantly learning new capabilities and evolving new leadership behaviors alongside the company’s growth stages.

Every startup CFO needs to think two stages ahead to be effective.

Be humble, stay a curious learner, and fill your gaps as quickly as possible.

Up Next Week: We’ll wrap up this series with my first ever publicly published CFO Scorecard to put a bow on these CFO standards and give everyone a clear and objective way to measure this evolution and personal progress.

Bookmark this Series!

Up Next Week: Part 3 - CFO Scorecard

In case you missed it… CFO Roadmap Series: Scorekeeper to Operator to Architect Part 1